What Every First-Time Homebuyer Should Know in 2025

At The Freund Group at FIV Realty, we specialize in helping first-time homebuyers across League City, Friendswood, Clear Lake, Houston, and Galveston confidently make the leap from renting to owning. Here’s what you need to know about buying your first home in 2025.

📊 Market Conditions for First-Time Buyers in 2025

- Inventory is higher: Buyers have more homes to choose from than in recent years.

- Prices are stabilizing: After rapid appreciation, many Houston-area neighborhoods are seeing modest declines or flat growth.

- Interest rates are steady: Hovering between 6.5–6.7% for a 30-year fixed mortgage — higher than pandemic lows, but historically still reasonable.

👉 This means first-time buyers have more leverage and less competition than in recent years.

📝 Step 1: Get Your Finances in Order

Before house hunting, review your finances:

- Check your credit score (620+ for conventional, 580+ for FHA).

- Save for a down payment (as low as 3% with certain loan types).

- Budget for closing costs (2–5% of purchase price).

- Factor in monthly expenses like taxes, insurance, and HOA fees.

🏦 Step 2: Get Pre-Approved for a Mortgage

Pre-approval is a must. It tells you how much home you can afford and shows sellers you’re serious.

- Gather pay stubs, tax returns, and bank statements.

- Shop multiple lenders — local lenders in the Houston Bay Area often provide faster, smoother service than big banks.

- Get a pre-approval letter valid for 60–90 days.

🏡 Step 3: Define Your Priorities

Make a list of must-haves and nice-to-haves:

- Must-haves: Location, school district, number of bedrooms.

- Nice-to-haves: Extra space, upgraded kitchen, large yard.

👉 Many first-time buyers in League City and Friendswood prioritize school districts, while Galveston buyers often focus on proximity to the beach.

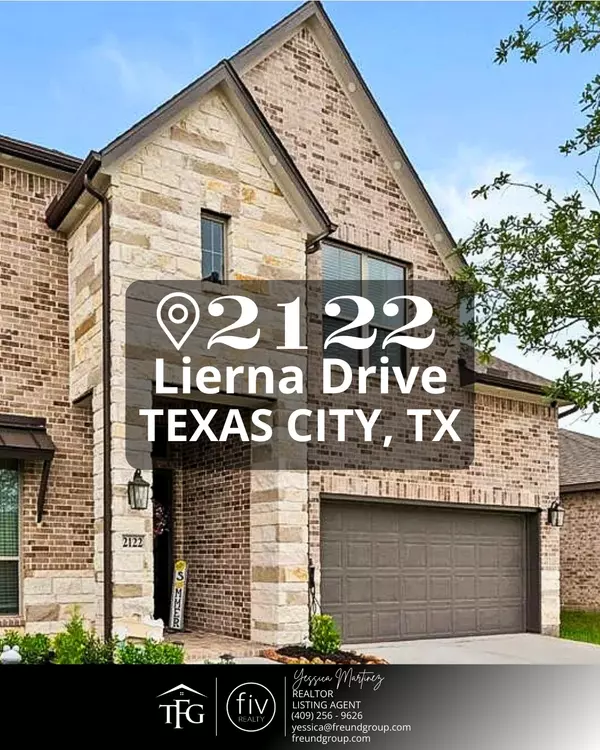

🔎 Step 4: Lean on a Local Realtor

A great Realtor helps you:

- Find homes before they hit major listing sites.

- Understand neighborhood trends (resale value, taxes, HOAs).

- Negotiate price, repairs, and terms.

- Guide you through inspections, appraisals, and closing.

At The Freund Group, we’ve walked hundreds of first-time buyers through their first purchase — making the process smooth and stress-free.

🛠️ Step 5: Don’t Skip the Inspection

Inspections protect you from costly surprises. If issues arise, you can negotiate repairs or credits. In Houston and Galveston areas, always ask about:

- Foundation stability (common issue in Texas soils).

- Flood risks (especially near the coast).

- Roof condition (age, shingles, storm damage).

🎉 Step 6: Prepare for Closing

On closing day, expect to:

- Review and sign loan and title documents.

- Pay your down payment and closing costs.

- Receive the keys to your very first home!

✅ Final Takeaway

Buying your first home in 2025 may feel complex, but with the right preparation and a trusted Realtor, it’s entirely achievable. By getting pre-approved, setting priorities, and leaning on expert guidance, you’ll be moving into your first home with confidence.

👉 Ready to buy your first home in League City, Friendswood, Clear Lake, or Houston?

Contact The Freund Group at FIV Realty today. We’ll walk you step by step through the process and make your dream of homeownership a reality.

Call The Freund Group at (281) 479-6683

Categories

Recent Posts

GET MORE INFORMATION